Sneaky fees: How restaurants, gift cards and tourist attractions are costing you more (Marketplace)

♪ [David] Fed up with hidden fees? [woman] [clerk] [David] In Canada's top tourist spot, they come with different names and different prices. [man] [woman] [David] We reveal where the money's really going. It's going to the owner of the property, to the operator of that property. Wow, just to make money off of tourists.

That's crazy. [man] 12%, oh, my God. They're making a living, man. Out of us. Is this the transparency you want? And when it comes to some gift cards you're giving, why do they keep on taking? Monthly maintenance fee: $3.00 per month, starts 12 months after activation. I don't understand the value that a consumer gets from locking their money up in one of these cards.

[David] Plus, an honest-to-goodness charge that seems anything but. If they're gonna charge 3%, I'm probably never going back. [David] What the Fee? starts now. [dramatic music] We're getting wired up...

And now turn to me. ...investigating some sneaky fees you might see at many hotels, restaurants, and attractions in Canada's most popular tourist destination. What do you think that is? -[woman] Tourist tax. -Uh, tourist tax.

The tourist tax. Okay. Where does that go? No clue. [David] Many think they're collected by government. You know what that is? No, I was, um, assuming that they're taxes here. Yeah.

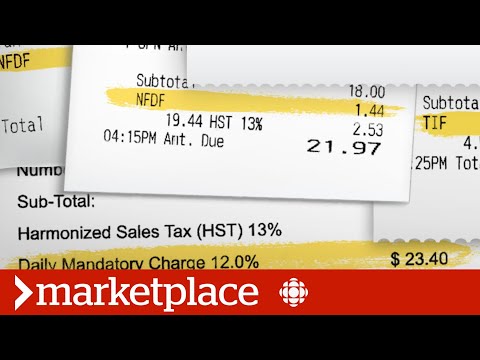

[David] Think again. Are you familiar with NFDF? -No, I'm not. -So, is it like gratuity? -Nope. -Wow. What is this daily mandatory charge? It's-- like, what they're charging us for? [gentle music] [David] To clear up the confusion, we're checking out a dozen hotspots to see how the mysterious fees are explained.

First, the Days Inn. [woman] [clerk] [David] At the Radisson, it's called a resort fee. [clerk] [David] At The Oakes Hotel, they call it a daily levy.

[woman] [clerk] [David] Different names, different explanations, but across the popular Fallsview district, one thing we do hear a lot... [clerk] [David] It didn't used to be that way. Back in 2015, customers could say no to the added cost at many places. Cheers. [undercover journalist] [waitress] [David] We know because we've been following the fees for nearly a decade.

[undercover journalist] [waitress] [David] Back then, it was typically a 3% add-on. In 2016, it increased. [undercover journalist] [waiter] [undercover journalist] [David] Then in 2017... [undercover journalist] [woman] [David] At the time, Niagara Falls' mayor Jim Diodati, told us he knew it was a problem. I wholeheartedly support a more transparent, uh, more accountable, um, way of dealing with this.

I think definitely it's confusing to people. ♪ [David] Not long after, they try to solve the problem by introducing an official municipal accommodation tax, or MAT. $2.00 per night at hotels with funds going to the Niagara Falls Hotel Association to promote tourism.

[guide] Today I'm taking you up 520 feet in 52 seconds. [David] But now we're hearing those tourism fees... [guide] Here you go. Enjoy your visit.

Thank you. [David] ...are being added on top of that tax. So, we're going in to see where things stand now, starting with the Skylon Tower, where they charge something called an APF. [undercover journalist] [clerk] [undercover journalist] [clerk] [David] It's an extra 3% here.

Over at T.G.I. Friday's, no mention on their menu, but a surprise on the bill. [waiter] [David] Here, it's called the NFDF. [undercover journalist] [waiter] [David] At the International House of Pancakes, the fee shows up again. [undercover journalist] [waiter] [undercover journalist] [David] And this employee lets us in on a little secret.

[waiter] [undercover journalist] [waiter] [David] Over and over, we hear the fees go towards city upkeep, the Falls and the fireworks. [waiter] [David] But where's the money really going? It's going to the owner of the property, to the operator of that property. [David] Janice Thompson is the CEO of Niagara Falls Tourism.

Here's something called an NFDF of 10%, an additional $8.00. Um, where does that money go? To the operation of the-- of the property. [David] But that's not what we're being told at most of the places we visit, including Applebee's. [undercover journalist] [waitress] [undercover journalist] [waitress] [undercover journalist] [waitress] [David] Slick marketing or sneaky practice? ♪ We head to Baltimore to get an expert's take.

To me, I think it's clearly deceptive. [David] Andrew Ching is a professor of marketing and economics at John's Hopkins Carey Business School. In Niagara Falls-- we've been tracking this for years-- not only do the extra fees get added on to places, but the percentage being charged is going up. [Andrew] This is an interesting point because this is a tourist place.

Most of the people just go there every once in a while. Uh, maybe once every few years. And these people may not really notice this change of this fee. Do you think that's fair when you have staff saying one thing, when you have names like Tourist Improvement Fee, but it's actually just revenue for the business? That's obviously not-- It's not fair. It's not right. Yeah.

This is, uh-- I would say this is very problematic. [David] At both the Embassy Suites Hotel and Four Points by Sheraton, they acknowledge the money collected stays with the business. [David] At the Embassy, it's an extra 12%, the highest we've seen. We're also being told the other charges are mandatory.

That we don't have a choice. That's correct. They-- Because they're part of the-- the fee that's charged by the operation. But it didn't used to be like that. Well, life changes. That's all I can say.

I guess business changes, costs go up. [David] A big surprise to the tourists we talked to. Where does that 10% go away? The business gets to keep it.

Wow, just to make money off a tourist. That's crazy. [man] 12%. Oh, my God. They're making a living, man. Out of us.

I've never heard of that. Like, people come here to gamble. It's a bit of a roulette with the prices of what you're gonna pay. Totally.

[David] We could pick three places. One doesn't charge at all. One charges 10%. One charges 12%. -That's insane. -That's crazy. [David] These tourists aren't alone.

Many employees at these restaurants agree. Check out Starbucks. [undercover journalist] [barista] [David] Others, including those at Outback Steakhouse, offer to remove the fee when we ask about it. [undercover journalist] [waitress] [David] Finally, we visit Milestones for a meal. Here, it's called a luxury fee.

[waitress] [David] And then she says something we aren't expecting. [waitress] We've been following this story for a few years now, and it seems as though things have gone from bad to worse. [David] When we talked to Niagara Falls' mayor about the fees in 2017, he agreed change was needed. I wholeheartedly support a more transparent, a more accountable, um, way of dealing with this. [David] Now we're back to meet Jim Diodati. Back in 2017, you said you supported a more transparent and accountable approach.

Do you think that's happened? Yeah, well, we, at that time, didn't have an accommodation tax in town. And since then, we now do, and it's a transparent process that we audit regularly and-- and use those monies to market the destination. And yet the fees that previously existed still exist, and in many cases, have gone higher.

Does that make sense to you? Well, I mean, no one likes to pay fees and no one likes to pay taxes. That's one thing I know. Certainly in the hospitality industry, it's not a surprise because they'll send you your bill in advance. So, there should be an awful lot of transparency where you can decide at this point, "No, I don't think I wanna do that," or, "I wanna dispute these fees," or, "I accept that's part of the cost of coming here."

I'm just gonna pull some of the bills here. While hotels typically let customers know about the fees in advance, Diodati disagrees with other businesses which tack it on the bill without warning. If you see where it is, you know it's right below tax. There's something called NFDF that adds another 10%. This one, different name, BIAF, charges 8%. Here's one charging 8% and they call it a TIF.

It goes by a lot of different names, but it's right there beside tax. Is it a problem the way that it's showing up? Is this the transparency you want? No, I don't think that's a good idea. And-- and myself, having been a small business owner for 25 years, I can tell you that your reputation's the most important thing that you have, and I don't think it's a good idea. [David] Diodati says the city has no control over these fees.

It has nothing to do with the city. We don't see any of it. We don't, uh, regulate it, legislate it, oversee it.

[David] But the province does. Ministry of Public and Business Service Delivery and that would be the group that should be having a look at that, but-- What-- what would you have them do? I would hope that they'd investigate to find out, first of all, if it's allowed, if it's legal, and-- and the question is if it's a good idea. [David] So, we ask Ontario's Ministry of Public and Business Service Delivery. They direct us to the Ministry of Tourism Culture and Sport, who direct us right back. Finally, we're told businesses can collect fees, but need to be transparent.

And any misrepresentation about the purpose of a fee may be illegal. We reach out to all the businesses to let them know about our findings, but a lot of them don't get back to us. It is important that they know what we're going to report. So, we're dropping off letters at each of them. I'm David with CBC Marketplace. I just have to put this into the ma-- hands of a manager.

It's related to the extra fees that get charged, -uh, specific to Niagara Falls. -[woman] Oh, okay. [David] It's like-- it's a letter to the general manager. [woman] Okay. [David] I-- I work for CBC Marketplace.

-[woman] Okay. -[David] It's related to the luxury fee, which I believe is 6%. -So, I work with CBC. -[man] Okay. [David] It's just about the-- that NFDF fee that gets added-- [man] I figured. We heard about it.

[David] Yeah. Of the 12 places we visit, some send us statements. Days Inn, Milestones, Embassy Suites, and Starbucks tell us they don't control the pricing. Charging those extra fees is unique to the independently operated locations in Niagara Falls. The Radisson tells us their 4% resort fee is on the low end compared to their competitors, and goes towards amenities guests can enjoy while staying at their property, and not an environmental fee, as we were told.

They say they're working with staff to ensure the messaging is clear moving forward. Every few years, we come back here, we find the fees are on more places, that they've become mandatory, that they're more expensive. And we hear from somebody like you saying, "Well, the province should do something about this." How do I know I'm not just coming back here in four or five years to talk about the same thing with the same answers? Well, the-- the unique thing here is we're just rebounding from Covid. So, we've been shut, we've been shut down.

So, everyone's scrambling to get back on their feet. But definitely, it's something as they're getting on their feet, we're gonna have to talk about. And I'm not gonna wait until that time.

I'd like to speak with the province now. What do you say to those tourists who feel they've been duped? I always tell people, first off, is make sure, buyer beware. And-- and if it's on a hotel bill, you should have received an email confirmation. You should have read it, right? Do your diligence, do your homework, right? -And on restaurant-- -If it's not there? Well, then you don't have to pay it.

You can't tell 'em after the fact. You've gotta be open and transparent. [David] You've heard what the mayor thinks. Now listen up to what these tourists think. I just don't think that it's right.

Or at least let people know, you know, beforehand. It's, like, bad for business. It's not transparent. So... And it-- it would change where we go, especially if we're going to pay an arbitrary $23 a day to stay somewhere. Businesses should know that they-- they cannot charge people and they-- they-- they just cannot charge like that.

Every-- everyone should be aware. Well, this is very good thing I got to know today and for sure I'm gonna-- You're gonna start looking for it? Yeah. For sure. For sure. [David] Coming up. Is that gift card costing more than you think? This is not cool.

An extra $3.00 if I don't use it, that's a rip-off. [David] This is your Marketplace. ♪ We're putting shoppers to the test. Gift cards, do you ever use 'em? -I have used them before, yeah. -Give them, get them? I've given them, I've gotten them.

Ever get gift cards? Yeah. All the time. [David] Giving plastic is popular these days, but are all gift cards created equal? Do you ever buy these? Of course, yes. Actually, I get them as gifts more. [David] Just before the pandemic, Sam Rustin gets a Visa gift card worth $75.

I wanted to save it just because I knew gift cards don't run out and I wanted it for when I would need it. Is that an example of what you got? Yeah, this is what I got, essentially, with $75 put on it. [David] It has the Visa mark, but the company has little to do with this product. It's called The Perfect Gift, but Sam discovers it's anything but. Monthly maintenance fee: $3.00 per month,

starts 12 months after activation. [dial tone] [David] She calls the number on the card and discovers her balance is gone. I was in shock for a few seconds because I-- I-- I had no idea that that was even a thing that happened, especially on gift cards.

[David] In Ontario, store-specific gift cards don't have such fees, but these ones play by different rules. To find out why... meet Jonathan Schachter. What made you wanna get into the kind of law that is there to protect consumers? Uh, Marketplace played a role, I'll be honest. -[David] Really? -Yeah.

[David] He's a consumer protection lawyer who's filed class action lawsuits on similar gift cards. Around 2014, federal rules came into force for companies that issue cards and are federally regulated. [David] Things like banks? Like banks or loan companies. And those companies under these new rules, federally, are allowed to charge certain fees. [David] And if you take a closer look at the card, it's issued by the People's Trust Company. [Jonathan] I don't love these products.

I don't understand the value that a consumer gets from locking their money up in one of these cards and having the money gradually taken away from them. [David] Sam's not giving up. She calls up the company to find out more about the fee. [man on phone] But, um, I'm so sorry-- [David] The company behind these cards is the People's Group.

They tell us the monthly maintenance fee helps support the cost of operating the network, card processing, customer service and other costs. They add, they follow the rules by disclosing the fees right on the package, and that they only start charging 12 months after activation. We share that news with shoppers. How would you like it if someone gave you $100 gift card? Uh, pretty good. [David] Pretty good. What if that card started to go down in value after a year, even though you hadn't spent anything? -Not very good. -I don't like it.

What if you get it and you never use it -and then it's gone? -[David] Yeah. You know, that's kind of wild. [David] Well, what's your message to a company that would do something like that? My message, cut it out. This is not cool. An extra $3.00 if I don't use it, that's a rip-off.

[David] Schachter agrees, and he's got some advice. Vote with your feet. Don't buy the cards. If you're-- or, you know, if you're-- if you're buying a-- if you wanna give someone a gift and you don't know what you wanna get them, give them cash. You might lose it in the couch, but you'll find it later and it'll keep its value.

[David] Coming up. It's called the honest to goodness fee, but... I hate the word "honest" in that, quite frankly, -'cause it's not. -[chuckles] [David] Get more Marketplace.

Sign up for our weekly newsletter. Cbc.ca/marketplace. ♪ This is your Marketplace. [upbeat music] We're going out for dinner, checking out Chuck's Roadhouse Bar and Grill. -[woman] Two, please. -[hostess] Two?

It's for two of you guys? All right. [David] With over 60 locations in Ontario, the company promises good food at affordable prices. [announcer] Chuck's Roadhouse: food the way it oughta be.

Priced the way it used to be. [David] Gail Etherington takes issue with their pricing model. It's right here. Honest to goodness fee: 3%. $1.48. [David] On a recent trip to Chuck's in Napanee, Ontario, she notices that 3% fee.

[Gail] When I asked the waitress what that was about, she said that was to ensure that you're getting fresh, quality food. -So, I said-- -What would you get if you-- [Gail] -- "Well, What was I getting before?" [both chuckling] Anyway, I just said to her, "You know what? I'm not paying that." [David] It's explained on their menu and on their website. [Andrew reading] "Something has to give and we definitely don't want that to be our quality." So, it sounds like this is the way that they want to maintain their quality. [David] Marketing professor, Andrew Ching, says that extra charge is bad for business.

[Andrew] The most honest way, if you wanna raise the price by 3%, just change your menu. Increase it by 3%. Uh, why do you have to add another item? I'm not really sure, you know, what this restaurant's really thinking. [David] Gail complains and gets the fee taken off. And when she came back she said, "Okay, he'll take it off, but he won't do it next time." And so I said, "There won't be a next time."

Like, I hate the word "honest" in that, quite frankly, -'cause it's not. -[chuckles] The owner of Chuck's Roadhouse is the Obsidian Group. And they say they've always been transparent about the fee and that charging that extra 3% allows them to provide the highest quality food at the lowest possible prices, while operating efficiently.

I'm-- I'm sort of a person of principle. It's not the amount, it's the principal. And if they're gonna charge 3%, I'm probably never going back.

2023-02-12 01:50