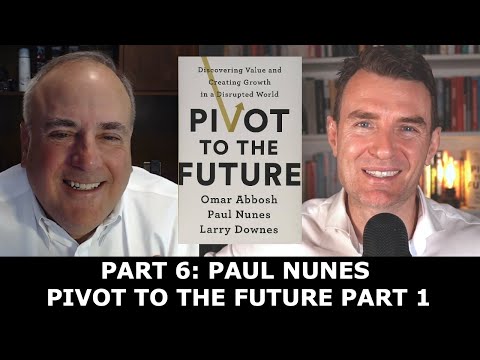

Pivot to the Future with Paul Nunes Part 6

disruption by digital Technologies that's not a new story but what is new is the wise pivot a replicable strategy for harnessing disruption to survive grow and be relevant to the Future it's a strategy for Perpetual reinvention across the old now and new elements of any business rapid recent advances in technology are forcing leaders into every business to rethink long-held beliefs about how to adapt to emerging Technologies and new markets what has become abundantly clear in the digital age conventional wisdom about business transformation no longer works if it ever did based on an Accenture Zone experience of Reinventing itself in the face of disruption the company's real world client work and a rigorous two-year study of thousands of businesses across 30 Industries today's book reveals methodical and bold moves refining and releasing new sources of Trapped value unlocked by Bridging the Gap between what is technologically possible and how Technologies are being used this freed value enables companies to simultaneously reinvent their legacy and current and new businesses we welcome back friend of the show he's become a friend of mine I have to say from all the times we've forced forced them onto the show forced us together he's back to join us to explain the brilliant book the third in the trilogy of these books pivot to the Future Paul Nunes welcome back thanks Aiden great to be back it's great to be back man and it's great to have you back we're on to the last book I'm sad to say and we're going to do a two-part on this but I wanted to do something for you a little bit here and I noticed in the book in your dedication that you dedicate your side from with your co-authors you dedicated to Hilda and Anne who you say always made the most of every situation I thought you might want to do the same with this episode thanks for doing that it's nice that you noticed that um who that was our Hilda Nana actually my mother-in-law and my mother and both of them had sort of a shared treat that comes up again again the book so I thought it was actually kind of um good there's two women who really managed yesterday today and tomorrow at the same time they brought a lot of their immigrant background a lot of the struggles that came from their immigrant backgrounds in a really tough life but lived in the moment but also could see the future and had so much hope for the future and I think you know to to understand why they were so special in the creation of this book was really understanding how um to live a full life I think you have to live both in the past but in the today and in the future and that's what a lot of the book is about well let's build on that because another piece of your history your past your old is Accenture itself like you had a lifelong career and an Accenture and part of this book is looking at accenture's own reinvention specifically Accenture would need to balance its strategic initiatives around the three distinct phases you in in their life cycle you say here the mature products and services approaching obsolescence that's the old today the most profitable offerings of the business the now and then the Leading Edge Ventures targeted at the immediate immediate future the new and what's interesting is given the time that's elapsed since you wrote the book A lot of these have become the now they've become the present for Accenture and you are part of that strategy which must be so fulfilling along with your co-authors as well well it really was exciting and just to uncover a little bit of what we're talking about in the old the now and the new as we studied what was going on with digital disruption and try to understand in a bit richer way how companies were winning in Big Bang disruption now even incumbents were managing that we really wanted to understand and have some ideas about how to best manage digital disruption however you want to Define it that was going on at the time it is still continuing on this whole power of Moore's law again continues with artificial intelligence and these others so there's this constant you know moving of the Horizon we talked about trapped value but the Horizon of what's what's possible in a business thanks to technology keeps expanding and expands it and accelerating and really a geometric rate and the problem is that most companies only change in a pretty linear rate right and often it's in a very stepped it's in a punctuated way um that we call transformation so you know meanwhile Technology's going like this but companies are going like this and they're designing transformation programs so this was the big question was well you know for me and for my colleagues at Accenture was how do we Circle that square how do we you know fit that in how do we create strategies that deal with the fact that technology is getting away from us in a very linear transformation kind of world and you know where does the s-curve fit into that as well then we came to the recognition we looked at we studied all these companies particularly the incumbents that were succeeding and seemingly succeeding in digital transformation and we realized that there were really three Horizons that companies were managing against and doing so simultaneously and what's important is recognizing that that's the old now and the new not just the now the near term and the far term so you know Alchemy of growth there's lots of things you know bifocal near and far there's a lot of stuff that talks about the horizons from now going forward like I said you know McKinsey has a nice three Horizon model in alchemy of growth and such but it was always forward-looking and what we found really interesting in our research was the focus on on the past what Bruce Henderson might call and his model the dogs right and what's really interesting for those who are familiar with the um BCG but uh Boston Consulting Group and Bruce Henderson's work that's where we get the term Cash Cow from right because there was The Matrix of the four kinds of businesses I think our listeners will probably be Vaguely Familiar at least with this um but what's really interesting is that you know some businesses can be dogs they can be cash cows they can be Stars what was always interesting to me as I learned is that dogs didn't mean that they were bad businesses there were more businesses you kept because you loved them like a dog because they may be old but you had a Sentimental attachment that didn't make as much sense from business or an economic but that explains the nickname my wife has for me yeah exactly you're not a dog but it also explains why people will spend mostly thousands of dollars on surgeries right for uh for their pets um it doesn't make economic Sense on a certain level but it certainly makes sense um because we love our diet so the importance of the dogs is most companies have old businesses that they're very emotionally attached to and rightly so in many ways because it's what brought them to the table it's what gave them their greatest success real coke old Coke you know new code but um people remember the the bringing back of the old Coke formula it's you know it's more than just an emotional attachment people really like the old products but sometimes they're not always as profitable but these businesses are really important to what we saw as successful businesses as you balance historical business with the now business and the new business so one of the key reasons is because the old business is critical in funding the new businesses oftentimes they throw off a lot of cash more than even the cash cows and we'll talk about that in a moment um you know you could say there were cash cows but as they start to shrink in that it's a different kind of animal but the important thing is that these businesses are really critical as the anchor businesses and by anchor I mean the one that secures you not the one that holds you back but actually Fitz is the foundation that helps you from getting blown off course and finding your way across these Horizons into the future there's a key term as well that constantly pops up throughout the book and it'd be important to maybe describe this at this stage given the book is called pivot to the Future you introduce a term that you guys called the wise pivot yeah the wise pivot is really this idea that what happens is you have to jump three curves at the same time so there's the old the now and the new what happens is actually you move across all three of those at the same time and I'll go into that in a bit more detail so let me explain that a little more it's like what's going on with these three curves then if we're managing three curves simultaneously and by three curves again I don't mean the portfolio of businesses I don't mean you know you have an old um if you're Nokia you have an old business in forestry and now business and boots and a new business and that I'm really talking about businesses in essentially the same area but of which have different levels of maturity I'll give you a good example Pepsi PepsiCo is a great example of a company that was anchored is anchored in the old sugar water Pepsi products right but it has a now of a broader range of better for you products and then all the way to the very healthy food and the Leading Edge stuff like um overnight oats Works nicely with their oatmeal business which is pretty much Quaker roaches the dominant U.S and probably a leading uh worldwide oats um maker Quaker Oats so we see this this multi-horizon thing and the story um really goes to Indonesia the CEO at the time the and the Really game-changing CEO who saw that she had a move away from research in just pure next you know strawberry flavored colas and vanilla flavored colas and actually worked and it's an interesting story she actually worked through the research lab in their their head of r d and forced that person to come out and and look at the company in a much broader way because what happens is what we found is a lot of times it's the company it's the part of the business that's making the most money that funds the research and that research can be about product extensions in that business and so what happens is you really have to have this multi-horizon View and then you have to step back and say okay well here's where the profits are coming from but here's where the profits need to be reinvested so that I can build the balance I need um to go forward and that takes a really Visionary CEO it takes a CEO um and a leadership team that can be can create a compelling vision of the future that has all three Horizons not just in their own mind but in the the next level Downs in the c-suite but also all the way down to the employees who can recognize okay you know to the line level employee has a sense that you know I'm proud of where my company is going and all the things we're doing in Horizon you know the new but I'm also quite proud and and successful and we're very successful in the old as well um continuing on with that and so this ability to manage those I mean we can talk a lot more about different companies that do that successfully and how um but really recognizing that it's no longer a function of exploiting a single business but building this kind of synergy across three Horizons I think it's always useful to get a handle on the terms on the kind of mental model for the book especially when we're doing these deep Dives and there's a line here a quote or an excerpt that I wanted to share and so many I thought of so many of our poor listeners who are stuck in this Paradigm at the moment they're trying to unlock the old to fuel the new and this line really spoke to me you wrote even if sufficient Capital can be freed up inertia may still hold back real change today's processes on it systems after all have been optimized sometimes over decades to support the core they are literally hard-coded to implement a strategy perhaps long forgotten these corporate antibodies May unintentionally destroy initiatives with the potential to lead managers to the Future the old wakes up every morning determined to kill the new the solution requires a reallocation of resources driven from the top the CEO the CFO and other members of the executive team that spoke volumes to me because I've been in that situation where you're in the trenches maybe a middle management trying to drive the change from the middle or below and it's so difficult unless they're unlocked these resources from the top including people and Financial Resources yeah I think that's the key that we saw throughout the book and it's it's interesting because it's simple but complexes so many of these things are right I think the simple lesson is that everybody has to be on the same page about where the company is at what they're doing and where they're going um I actually probably take a little bit of exception to some of the the thinking of you know the the old wakes up figuring out how to kill the new um I think that's true and true experientially as we we've seen it only to the extent that the old is scared and panicked and doesn't know what's going on and doesn't see that there's a plan and a vision in the company and the in the leaders um and the best companies we saw um there's actually that becomes less and less true as the old starts to really understand what the plan is what the strategy is and where you're going and how you're going to get there and what the plan is for the old as well because corporate needs to be you know the top management needs to be very specific about what the role and the plan is for the old um and so you know thinking about that in terms of resources I'll give you you know one example one thing that we found that was really interesting in the research was that the majority of companies and we did some side research on this as well and there's others have done this research but most of a business's profits go to reinforcing its own business so we saw that even in ourselves at Accenture that defer time a lot of this spending on R D development was going to the now and the old businesses because they were the most profitable um and they wanted to keep it and they were like you know just leave my business alone we'll be fine you can do what you want but you know leave me my money and what happens is one of the toughest ones we talk about in the book one of the toughest things a business has to do is get those leaders of the old the now and the new businesses and say look we as a team need to optimize our investment in spends and later in the end of the book we talk about why reallocation of assets is strategy is asset allocation and I don't know if I've told you that before it's just a saying that I love um for over all the years but really you know as a strategy that doesn't reallocate assets is not a strategy nothing changes if you don't reallocate assets so it's all about asset allocation and we'll get to that when we talk about the second half of the book but that being so when you have a multi-horizon business all those Executives really have to be on board because if you're going to take money from this side and say look we're not going to reinvest it in your business because this is the plan to Sunset that business getting those folks on board recognizing well you know the sun setting of that business is critical to our success and the revenues that you're generating and the profits you're generating are critical but this is where we think we're taking the company and you're part of that you're you know you're you're feeding your children essentially you're you know and when you you know and when the old gets a parent mentality and gets a um you know a generational mentality um and stewardship mentality of a firm particularly in you know incumbents that have lasted a long time they start to see more what their role is um and then they stop waking up trying to kill the new businesses but uh they get on board and that's what we saw again and again so that's that's the objective but to do that you really have to communicate and you know we joked about that earlier when we were talking by ourselves but this nature of communication but you know communicating communicate and communicate and make sure that you know people are not just being told it or hearing it but they're actually internalizing oh you know I I'm living in a multi-horizon company I wrote about this in my own book that when I lived in the Phoenix Park in Dublin which is this beautiful park it was uh not as a feral child although people taught that back then but uh I had the great privilege of of being brought up there and I remembered that my dad was responsible for the renovation of the park and he replanted the Main Avenue and I remember him telling me because he used to bore the life out of us telling us stories about what he was doing and stuff like this but they stuck with me they got in there somewhere in my mind but one of the beautiful things he said was they they when they replant an Avenue like that that's a long time in place they they put these budding trees in between those trees because the older trees protect them and I always think of that beautiful analogy for exactly what you're saying that the the old has their Noble role in protecting and nourishing the new yeah that's fantastic I wish I had that had that metaphor for the book because I think that's exactly it is that you know um you want to extend the life and we'll talk a little bit more you know as we go forward about some of the unconventional wisdoms out there but you know old trees could be kept even longer than um they pretty much have a a normal lifespan too but yeah part of the role and part of the life cycle of any tree is providing the shade for the the next generation one of the things I found just to not to labor the the story but I I didn't write about this but I found it afterwards is even the you know when you remove when you when you have to fell a tree eventually the stump still plays a very important role and needs to be in place because it holds the soil together and there's a whole ecosystem around the roots Etc and and most people you know if you have a tree that's you need to fell they'd rip up the roots as well but the roots have really important thing and I think that that is something I felt in your work the whole time is not that you know you don't just whip out people and give them redones and try and push them out the door and try and bring in new thinking because there's a there's a knowledge Handover as well in organizations that's so important yeah that's a perfect lead name I think to the three unconventional wisdoms of the old now in the new that we discovered in the book um and one of the first ones and Crossing all of it was this idea of premature abandonment and we just saw that again and again because everybody thinks you know when you're the sky is falling digital's coming and a certain extent it is but you can't let that Panic allow you to make bad decisions about what might be you know decades or hundreds of year old you know Assets in companies so this idea of you know in the old the conventional wisdom of the old actually and you know Peter Drucker is great but you know I like to kind of shake things up when I talk about conventional wisdoms and new wisdoms you know Peter Drucker talked a lot about um what how you exit businesses that mature and that you know once a business and you see it even install points and that basically once a business has gotten to a market level of returns and is unlikely to have a sufficient Innovation to go anywhere that well those assets the conventional wisdoms those assets should be sold so that you can repurpose the the cash from that into other newer things and hopefully let those assets be used by others that can maybe make a better profit off of them because you're not making much off of them so that's the conventional wisdom is you exit old businesses and that's a Peter trucker thing and you can go look for that what we saw is the new conventional wisdom of pivot to the future is actually reinvesting and exploiting using the power of technology to extend the life of the old and actually use it as the seed to create energy and commitment to the new and I'll give you a good example of that um is found in Anheuser-Busch Budweiser the king of beers well a while back and this goes even before the Bud Light incident so we're not going to go there but a while back Budweiser was almost the king of beers was almost dethroned um when it turned out that these new entrants were really changing the game in beer and changing the game for Mass Market here and that was all of these micro breweries right so it turned out that microbreweries were coming on they were coming on the United States the tune of about 400 microbreweries a year um and the question was how was a mass Market beer like Budweiser that was losing sales and profitability how is it to respond now traditional Drucker Theory would have said well you would want to you know look for a buy or sell-off that business the business isn't really going anywhere um and and move on to the new but instead of prematurely abandoning it would Anheuser-Busch said was well let's look at what our cost structure is and and let's Embrace zero-based budgeting and let's see what we can do with new technology because of course zero-based budgeting and applying it really exploits the new digital Technologies to really understand where your costs are and and to drive out costs and business so they reinvented the business and were able to take out and bring out a billion and a half in new funds so they basically took out a billion and a half in cost and spent a few hundred million buying 31 new businesses mostly microbrews things like Goose Island Brewing Company very successful microbrew but that's the way that rethinking what technology can do to help you extend and exploit the life and they didn't have to give up on a core Anchor brand that was really Heritage and brings a ton of understanding about the brand and the Heritage to the customer um you know and again the threat from microbrews is very real it's very interesting that what's really threatening about microbrews is technology allows you to brew the same batch the same flavor again and again that was the difference of why microbrews today and I think that's a really interesting thing is that recognizing that microbrews Pros pose a different threat and a more real threat now because technology is aiding their competition so one could look at that and say well look you know I now have a new ability to brew a flavor at any scale I want wasn't really true that was the advantage of large-scale beers it was that you would have you had the capability in only large Brewers could make a beer taste the same again and again and again um and so that's why it would be easy to say well all right technology has obsolesced any value to large-scale Brewing not the case that's the first piece of wisdom the second is a rewriting of wisdom so we talked about the dogs earlier on and and me and the dog house but we now have cash cows and you have new wisdom on cash cows that finally like although the book is about 10 years old it's like this is so relevant today more than ever before if you look at the differences of conventionalism so you know um Peter Drucker get rid of the old the New Logic is exploit the old but in the now the conventional wisdom of the now is what Bruce Henderson created the idea of the cash cow right which is incremental Innovation the the value of incremental Innovation is going to continue to go down so we called fancy terms the marginal utility of additional investments in r d is likely to go down basically the first dollars find the most the first most valuable changes we can make but as we keep throwing money at it we find lesser and lesser value add things and that that eventually starts to really burn up the profits so the insight there was that at some point and generally fairly quickly any Market dominating offering anything you're having success with should become what was termed a cash cow the right strategy is to pull back on the investment in improving the product because that's just money out the door unless you're making real significant improvements which in that case would be unlikely and then you get this engine that's just throwing off a lot of cash it's the cash cow now what we found is we looked at all these examples is that we didn't really see much of that and that's an important insight for technologies that when you've got rapidly changing technology I mean Bruce Henderson was right to a point was right from the data he was looking at because he didn't have the level of Technology Improvement and speed of Technology Improvement that meant that the utility of new r d was actually likely to be very good and very strong not simply um wasted money so in an environment of high-speed technology change there really isn't a window for being a cash cow because competitors can come in very quickly and super Siege I'm going to give you a good example of that is Google and search engines and it's really interesting because if you think about it you know what would the search engines that was Alta Vista there was excite there was lycos there was AOL there was you know for those of us who are you know old enough in the technology world we remember that there actually were a lot of search engines in the old days um but then Google came on board and Google was slightly different because it actually was tuned for ads which was really important so it actually helped to move a ton of this digital ad spending online because you could actually tie ads to the searches that people were making um so in 2018 Google had roughly 63 percent of the 83 billion dollars in ad spending in the US on digital ad spending I mean yes which is pretty extraordinary and so that would have been a perfect time for conventional wisdom to say okay time you can back off um Google didn't Google actually spent hundreds of millions of dollars um at one point in 2017 they did 31 000 side-by-side experiments to see what would work better which led to 2500 changes in their core product um which is a profound level of change in Innovation for something that should have been a cash cow right but the recognition and the reason I tell that story is because Google recognized that even if with the dominant position there was no end of innovation in search engines and that for things like Microsoft Bing um were just around the corner and we're real competitors um and so they couldn't take their foot off the pedal as they say take their foot off the gas going forward and I would say you know they still haven't so um the new insight in the now is there is no cash cow be very careful about thinking you're gonna milk um the the profits of a certain business because you know once you start to do that you can pretty much be sure that's that's the end of that business and then the last element of conventional wisdom change that I would just talk to you is is the new and so in the book we talk about you know the change in the logic the conventional wisdom of the new the old conventional wisdom of the new is that there is some new out there you have to get to you simply have to find this technology promise you know we talked a lot about truth tellers and that in previous discussions but this you know what is the vision of the new technology but the reality is that it's not just about getting to the new it's about actually making some profits in the new and it turns out how you do that what we saw in the winners was actually very different than simply getting to the new and a great example of that that I really like is Toyota and test uh versus Tesla if you think about Toyota and Toyota and the Prius one of the things about Toyota that was interesting in Toyota visioning thing every 10 years Toyota has a visioning session where they do all this work and they get all the folks together and they they actually publish it it's publicly available you can see the the various ones they've had over the years and one 10-year visioning session they came to realize a while back was that we couldn't make a car for everybody in an emerging middle class world and that we couldn't have gas powered cars forever we were going to need some alternative but what they recognized is they pursued the vision of that that said all right we're going to need to provide millions of more new cars but we can't do it on a on a pure fuel basis was the need for electric cars but they realized that the technology wasn't there for electric cars electric cars had all the problems that they have today they weren't they didn't go far enough they you know tended to be dangerous at the time because of various things that you know they came to the conclusion it just wasn't going to work but what they did consider was the hybrid and that was the basis of the Prius now in the history of the Prius it's it's interesting in 1997 Toyota launched the Prius spent a billion dollars to create it four years later in 2001 it was profitable Ten Years Later in 2007 it had seven years later less than 10 years in 2007 it had a 3 100 profit on each car which was about the same as the profit on any other um car it was selling and in 2017 they had sold four and a half million and they were the only company ever and I think it's still true to make a profit off of hybrid vehicles to make a real profit now consider Tesla and I always like to ask people in audiences you know when was Tesla created and started in the electron in the electric car business you know with a vision with getting to the Future well they actually started in 2003 so we're going on 20 years of Teslas and now we start to see a little bit of profitability but when you think of those two trajectories you can see how getting to the future is not the critical question getting to the future profitably is our critical question I'll give you another example of that on the negative side which we're you know we don't like to do but it helps to understand where it can go wrong is GE and predicts right because GE made a huge commitment and predicts to internet of the future we can talk a bit more about the nature of Internet of the future which is really interesting the internet of things I'm sorry um this internet of things you know we're going to connect the internet to everything but the problem was if you sell off your seed corn so you look at the GE that was selling off its anchor businesses you know GE Appliances well they say you know appliances is about as mature businesses maybe could be white goods right so we'll sell it off to higher and the higher becomes the world's leading Appliance maker and actually has some good uses for and anchors part of its Appliance business with ge's appliances then we sell off you know GE Capital we sell off all these other businesses and we start pouring all that money into the future but that future maybe and doesn't actually come at the time table we want it may come but the key is the timetable and here's a bit of Paulin in this logic that I confess I don't have all of the proof yet but really wanted to study is this Insight that it's not about you know Innovation versus invention Innovation and only schumpeter and a few other economists have ever really made the separation between Innovation and invention but we need to talk about those separately because Innovation is about the application of invention if one wants to try and create some specificity of language doesn't have to be that way but if you create that specificity of language then you realize okay the useful application is really the profitable application of of an invention or technology is innovation but I can only innovate to the extent that I have the technology and the invention ready to do that and the key is I can accelerate Innovation but in accelerating invention is very very tough so I can move us more quickly or more slowly to electric cars but improving the core physics of Battery Technology inventing new batteries that's a lot sketchier that's a lot less certain and so what companies really need to do is they think of invention and and Innovation as they think of innovation they need to separate that out and they need to understand are they betting on improving the speed of innovation or are they betting on improving the speed of invention and if you're betting on the speed of invention changing the speed of invention you'd better have a really deep pocket or be really good at what you're doing in science because invention is a really hard thing to predict beautifully beautifully articulated man I always think about that as in you know the term have enough Runway but you need to be able to buy their own way that's the thing you need to be able to keep people in the business etc etc have it as a as a project you know I always use that as advice for people from a role perspective if people are looking to move on to a new role particularly if it's a new industry don't just jump and go there like dabble with us you know do it slowly just like you would with different Horizons the old the new and the new the older now and the new exactly well and it's the question of the confidence level and it's a bit like Market betting on markets because what happens is we get plateaus of Technology where people say you know I'm tired of waiting on the next level of invention I'm going to make the current level of scientific capability work and in some ways iTunes is a great example it's like well we're not ready for Spotify yet but we are ready to sell individual digital songs from a Marketplace and we're just going to make that technology last as you know as a plateau for a period of time so everybody knew eight-track cassette tapes were not going to be the final answer to record the you know to recording of music but it serves a purpose now when companies think about these things what they have to do in hate to say guess or bet but it becomes a bet about whether people are going to wait for the next level of Technology capability or whether they're going to be satisfied with what it can do right now and I think what we've seen a lot in the the holdback of Electra of electric cars for example nothing wrong with electric cars conceptually in some ways you know um but we can argue about whether they're Greener or not but the thing is the battery technology is clearly not what we want it to be we want a thousand miles whether it's hot or cold we don't want 200 miles or 300 miles even when it's like well it's 300 miles but you can't run the air conditioning and so the key is understanding that you know we've talked a lot about that in uh big bang disruption understanding these critical and you know inflection points it's like well where are people going to say okay good enough nice job you created e-ink with the right level of contrast you created an electric battery that gets me x amount of miles now it's fine versus saying you know good job guys go back to the drawing yeah go back to the lab and see if you can get me to the next place and come back to me when you've solved this that and that um and it's tough but um but companies I think really do need to make that distinction you know what's going on in invention what's going on in innovation great Point man and you know it's also that when you when you try so when you make that attempt to build the new thing or to apply the new invention you're building a muscle inside the organization that will be applicable in the future just might be the wrong timing this is if you have got the pockets and you have got the runway you're building that strength in the company and that's so important as well well exactly and I think if you look at all the automotive companies right now and you look at the nature of competition and it's interesting you know well who's got frames and auto you know frames that can handle a shift to uh electric cars and that who's got the Technologies and you watch all the other Majors because you know obviously Tesla's kind of you know there's Fisker and others but the Tesla's always sort of been the leader and the champion of this electric car thing but you look at you know Porsche and VW um you look at uh some of the other ones uh you look at bulk you look at you I mean all the companies are in there they're all making their bets um and they're all learning along the way to your point exactly is that and it's a question of you know how much do I invest now to learn how much is there to learn am I going to learn something different when a different technology comes along and you can't rule out the all of the Chinese automakers and the you know the Indian automakers um and the others you know it's like you know where is this going to go and the last thing you want to do is have uh an automobile frame now the other challenge is that well even if you have an electric motor and this is a lesson that um Tesla learned the hard way I think it's really interesting you know they had the ability to do the electronic stuff but they didn't necessarily have the ability to buy large volumes of parts and to build the rest of the car in in the way that a large-scale maker could do it so when we started having things like Lane change awareness and signaling and you know some of the large car part makers Johnson Controls and uh those yeah they watt volume sales and so of course their emphasis is going to be on ones who can say you know it's like I need Lane changing sensors for you know guys I want to buy two three you know 40 million of them versus a smaller maker who has to struggle in the parts market for all of these new Leading Edge parts so in the same way we saw that because of covid where a lot of automakers were struggling for these all these chips and Leading Edge chips that supported a lot of their Technologies small makers can find that even without covid that they might be put on the back burner and so you know I can have the coolest electric car I just don't have you know maybe ventilated seats because I can't get them custom made for my car by the supplier who's got other things to do and wants me to buy 10 million of them not you know 500 000 of them brilliant brilliant man I love the examples that you give and Paul's books are so full of these brilliant examples one of the ways I wanted to describe the last part that we'll cover today is chapter one's called the trapped value Gap turning disruption into opportunity and Paul on his team use the retail apocalypse to illustrate Trump value and releasing value but what I thought was interesting here is that it's just like you say companies like Tower Records blame the internet so did many of the retail retailers and mall owners they blamed oh Amazon but what you say here is so important what distinguished the digital first retailers wasn't their Innovative use of digital technology it was a Relentless focus on making shopping more personalized convenient fun cost effective and even socially responsible this idea that even when they make the profits they're pouring them back in to make their products more consumer friendly Etc this permeates so much of what you talk about in this book retail has been a fantastic question since I I know at least back into 2001 probably a bit earlier and was one of the actual first places I began to do a lot because I'm actually a marketing uh major from back in my business school days so this idea of how we sell and channels changing and that was one of the first digital disruptions um you know all the way back to the beginnings of the internet and so it was this question of what is that actually going to look like and what kind of value does that create and so at the beginning of the book you know one of the things that my co-author uh co-authors and I talked a lot about Nomar Abbas was really a big on was this question of well how do we measure the value that's coming out of digital change because really when you looked across the whole book and what the purpose of the book really was to help companies understand the value opportunities in in digital disruption it's the question well what is you know value and how do you measure value and I had to go back to Omar's you know that's not as easy a question as you think it is you know what is value right because there's Enterprise that turned out there were at least four ways we could think about where value might reside so there was Enterprise Value and there was the value you could take by taking up the costs of an Enterprise there was industry value where entire Industries would be overturned like the taxi industry with Uber or hotel industry with Airbnb but you know be an industry level change then there was uh consumer value customer value and what we call customer Surplus consumer surpluses with the economists call and consumer surplus is really this idea that well I would give Uber ten dollars to send a car so I don't have to stand in the rain but that's not what they're going to charge me because there might be competition so that difference in what I would pay and what I would how I value it is what we call consumer surplus and that grows tremendously because oftentimes it's so easy to get into digital competition that we wind up with things at a much lower cost than consumers would really have to pay I'll give you an example I think it was eleven hundred dollars um they did some great research later than I would have thought they would have on the value of Google what would you pay to have a search engine and how much if I took it away from you you know what would you pay and I think the number they came up with the average person was like eleven hundred dollars a year is actually the the value you're getting that not that you're not paying for because some would pay more some would pay less but in total I mean they averaged it out but that's how much more value could actually be captured if you could capture the consumer value so I was like wow that's a really tough concept to get your head around and then the last one is societal value and when you think about like well all right if these digital Technologies are taking out say waste and one of the examples we use in the book is just Starbucks and the food one Starbucks got in the food they realize at the end of the day you can't resell the food what are you going to do with it well pre-digital Technologies would be very hard for this these stores to find places to move the food onto turns out with power of the internet and other things it was very easy for them to connect to shelters food banks and others to actually move the food up so there's societal value in that the point of that is you know it's a manic it's an anecdote sure but what we did is we saw it helps to understand it's like well how is it that Society itself is benefiting from digital transformation so you get the four of those together and so you know retail um transformation this whole idea of like you know what's the best retail solution and just you know it continues to reinvent channels and I can tell you one of the first one of the Fairly first articles we wrote and I'll point to its little self-serving is the customer has escaped an Harvard Business Review I wrote it with my co-author Frank Cespedes and really it was one of the first if not the first article on multi-channel management we didn't call it multi-channel management at the time unfortunately but it was about the Advent of multi-channel management because what we said was you know in as the internet happens and this retail stuff happens customers are going to start to cheat the channels what they're going to do is they're going to go in the store they're going to try it on they're going to put their grubby fingers from the food court onto the sweater right and do all this and then they're going to say I'm not going to buy this it's got stains on it I'm gonna go buy it online you know where I'll get a fresh one or whatever and where I'll actually be able to pay less because the online retailer doesn't have to pay for all the damaged merchandise or the floor space or all the other stuff at the mall um and so this idea of jumping in and out of channels and vice versa it's I'll look online I'll find the one I want and then I'll go straight to the mall and pick it up and then everything that I've invested in sales doesn't really help because when I get to the mall I don't want to talk to the sales person however well trained they are I know what I want I just want to pick it up and so we've spent the last 20 years trying to figure out all these different segments and I could go on forever about that and trust me I think you know that now but I encourage listeners to think about site segments the different segments of customers and what their Channel needs and demands are and I know that there are already every company is thinking about this already but we see it this constant evolution of you know what goes into creating a useful Channel who do you partner with to create an effective multi-channel experience um and so you know I remember I took channels in marketing in uh Kellogg uh School of Management years ago and to think of how that book has changed in 20 years is is profound well maybe on that I'll squeeze in one last part before we we conclude for today is that that is one of the key things about this book you say that so many monitors it's not that they're resisting the new it's actually that they've been trained to perfectly manage the now and the the old and that's one of the problems there's this paradigm shift that's required and it's really really difficult for senior managers who have got to the top of the ladder based on the way things used to be in a steady state environment but that environment's no longer with us yes their mindset and how they're educated and how they've been trained to manage an organization is I think that's a great point to end on Aiden because I think you you highlight exactly what we tried to do in the first part of this book very specifically and I've you've see it in the other books too but we try and call out the specific conventional wisdoms you know what did you learn in business school and I often joke with the people I I present to that you know how many people have been to business school and say well I can't give you a refund but I can at least tell you what they taught you that was wrong and what you need to think now but it's really important to think specifically about those things you know what are the things that we take as truisms in truth from you know research that you know exit the old businesses note the cash cows um these wisdoms get you in trouble when you get into the kind kind of environment we're in of a hyper Innovation hyper level of change that we see today thanks to the digital Revolution and it's exactly the goal of these series and indeed all Paul's work not only when he did it in Accenture but through these books and I hope through this series that we're doing for you that you both discover Paul's work welcome for Keynotes as well he's available to fly anywhere in the world and also read his articles both on the hbr a plethora of Articles all over the internet you'll find as well it's always a pleasure and by the way I just want to tell you before we even start recording me and Paul spent about 19 minutes countdown many rabbit holes and it's an absolute pleasure to do that as well so author of pivot to the Future Part One Paul Nunes thank you for joining us thanks Aiden

2023-10-01 21:46