Beyond Cryptocurrency: Blockchain for the Real World

All right really, this this this, talk is not, actually, intended, to be about cryptocurrencies, it's it's about, beyond. Cryptocurrencies, you, know what if you want to use blockchain, for. Real-world assets. And you. Know, like. Then I have this problem that you. Know most of what I work on a Stanford is my students, very excellent ideas, including, the next talk that you'll see so it doesn't really make sense for me to talk about. My. Students ideas but, currently I'm on leave and so I'm gonna tell you about something that I'm doing not at Stanford, but then Stanford requires this obligatory, disclaimer. Here, all. Right so. Let's. Say that you wanted to send a dollar from, here in the United States to a friend, of yours in India, all right so, if you try to do this with today's banking, system you'd, find that it probably takes like the better part of a week to do this that, to send your $1 you'd probably be spending $20.00, in fees it's, likely that your friend in India would probably be paying more than $1 in fees to receive, this international, wire and. In, fact this. Scenario, is preposterous right, like nobody would actually, send $1.00 to India because this is just like completely, clunky. And ridiculous, today so. In an ideal world this. Would be completely as simple, as easiest, sending email right you just stick a dollar into your computer and it would pop up in India or maybe your friend you know could get six you, know 60. Rupees or something out of out, of out of some bank in, again it should be as easy, as sending email so. The obvious question you. Know. Is. This a job for blockchain, right one of these magical, Satoshi's has come down and given, us this amazing gift of blockchain, should. We be able to use this to send a dollar to India well. Before. We answer that question there's. Just so much hype around blockchain. I think we should cut through it and talk, about what is blockchain. Actually. Give us and really. It kind of boils down to three things so the first thing that we get out of blockchain, is coin. Distribution, how, do you invent, some new coin, out of thin air like, you know Bitcoin. Or. You. Know or any of these other coins, distribute. It to people in such, a way that there's a, limited supply, of the coin but people still believe it has value and that's something that you know in 2008. Seemed. Kind of impossible, and, yet we've solved that problem and boy does it generate a lot of headlines right cuz you've all these people who bought some asset for like pennies, and then it you know became worth twenty thousand dollars or close to it a few months ago yeah, so that, gets a lot of attention the. Second thing though is I think the, even more interesting, aspect. Of blockchain. And that, is that, what. Blockchain, gives you is it gives you a reversible, transactions. Even. With parties. You don't necessarily know, or or, trust, right so that's what allows, me to walk up to you like we've never met before we don't trust one another I can. Give you some digital, coin and. You can give me some physical real-world asset, that I can walk away with because, you're confident, that, that digital, transaction, is not going to be reversed and.

Then. That's kind of the third benefit, that we get out of out, of blockchain. Are kind, of a whole set of purely. Incidental benefits. That didn't really require any scientific, breakthroughs, right so this would be for example like blockchain, works 24/7, unlike the stock market that only works during certain hours or, you know credit, card numbers are terrible, they're just numbers it'd be better if they were public keys but you know and blockchain gives you like public keys naming, your accounts which is kind of convenient, probably. The one that has, also gotten. The most attention is, the. Regulatory, differences that you get from blockchain, because it kind of breaks all the rules it, creates, a lot of regulatory uncertainty and, so it's kind of allowed people to innovate sort. Of you know Airbnb. Or uber, style in areas that were you know probably, over regulated, but, regulated. For a reason and so what we really need in the long term is of course to harmonize regulation, across you know blockchain, and non blockchain, kind of things so I think you know numbers one and three have really gotten all the attention, but the, super interesting, one is is, number two and I'll get to why a little bit later on so okay, so why do we a blockchain well, because of this this paper. On Bitcoin. A, few. Years ago that basically had, this insight that we can solve problem. Number one and problem number two at the same time in a mutually reinforcing, way using. This technique called mining, okay. So what is my name well mining is basically, obtaining. New cryptocurrency, as a reward. For making, other people's digital transactions, harder, to reverse and, the. Mining, technique that's you know most popular, these days is called proof of work and. That's obviously the one that the Bitcoin uses, and and in, aetherium, and the. Idea is you solve this kind of hard search problem, that's a function of the entire history of transactions, plus a new batch of transactions. You want to commit and, it's. Very hard to solve that search problem but once you've found a solution it's very easy for everyone to verify, it so you, sort of put a whole bunch of work, into searching, for a blockchain, that solves these constraints, and if you wanted to reverse transactions, you'd have to do it as much work as all, the good guys have done to, create, an alternate, blockchain, but you know those guys got rewarded and maybe you won't get rewarded so you won't be incentivized, to do that there's, other forms of mining, like instead, of computation. There's proof of storage, and proof of memory and then, there's also proof. Of stake where you know in one way or another you, you kind of use. Your. Coins, to, people. You know your, clout depends on how many coins you have and that you. Use that to. To. Influence, what the next set of transactions, will be but. They all basically boil down to to mining. Okay. So as, I, said you know I think the most interesting thing about blockchain, is these irreversible, transactions, and, where that gets even. More interesting is when you have multiple kinds, of token, on the same blockchain, and you can trade between them right so let's come back to this example where I wanted to send a dollar to my friend in India maybe I'm at the US and bank 1 my friends at at bank, 4 here in India, and maybe. Bank, 4 has, a bank, account at another bank bank 3 in Europe these are called nostro, accounts when a bank is accountant in another bank and make, four might say hey if you had 93 euro cents to my accountant, bank 3 all gives whoever you want you know, 60. Rupees that at, my branch in in India you. Know maybe there's some other bank bank too that has accounts at both bank 1 or bank 3 and bank 2 says hey I'll I'll, trade, you you know if you give me a dollar to Mike, Bank one I'll give you you know 93 Euro cents at Bank 3 and, so what you could do is with, a block 10 you could pack this all together into an atomic transaction. And execute, this transaction, and. Actually. Change. Your dollar into, rupees, without. Trusting, any of the intermediary, parties like you'd like bank 2 right, and, so. In order to make this work what you use for banks to issue tokens, that represent, claims, on deposits, like in you know dollars, euros and and rupees and, then the ability to execute these irreversible, atomic transactions, so. This. Is a very compelling example, but there's something interesting here which is that I haven't used cryptocurrency, at all notice that there's no no Bitcoin, or aetherium or anything in this picture right these are just, currency.

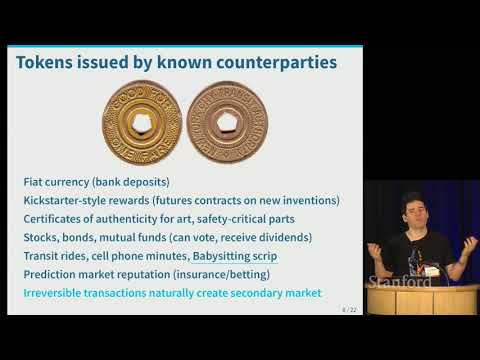

Backed Tokens, that have been issued by, these. Regulated. Counterparties, right because they're banks, and you know we trust our banks to be solvent because we have a whole bunch of. Infrastructure. Around making sure that our banks are are solvent and and and. Responsible. Okay. So currency. Is is one. Of many examples of, useful. Tokens, issued, by. Known. Counterparties. That, might, be useful to trade on a blockchain so another would, be say. Like Kickstarter, style rewards right you know I go to Kickstarter I spend, five hundred dollars to fund some you know special, foldable, canoe right and that entitles me in a year to get one of these foldable canoes if the project is successful so, that's effectively a. Future. For. This product that's that's gonna come out wouldn't, it be great if there were a secondary market for the future and if in three months I decide I don't want the canoe, anymore I could you know sell that future to somebody, else right well you can do that if the. Asset, that you got in exchange for investing, in this canoe, project, was on. A blockchain that, contained other assets like dollars and you could trade for those assets other examples, would be like certificates, of authenticity for. Art or safety, critical parts. You. Know any kind of securities, like stocks bonds mutual, funds, you. Know obviously we're used to tokens for transit, rides you know cell phone minutes. There's, a famous kind of economics. Paper on babysitting, script, and what goes wrong if you don't have enough. Supply of it but you know that obviously you, could do on this you. Know prediction, markets. Whatever. You can think of the, fact is that if. You can issue these assets, on a blockchain if you can tokenize, them an issue and I'm watching and the blockchain gives you irreversible, transactions, then kind of for free you get a secondary, market in any kind of asset, that you issue, okay. So what's the problem well. The problem is that block chains can fork so, in, July. Of. 2016. Theorem. Which is like the second biggest blockchain, executed, this weird. Kind, of irregular. State change they were just kind of hard-coded, into the thing now what happened well, basically. What, happened was that there'd been this contract. Called. The Dow and. There. Was a bug in the down because of that Dow people. Lost fifty million dollars, which at the time was a lot in the blockchain space, right, and. So. Basically. Everybody. Said oh this is this sucks you know we wish this bug hadn't been there you know if only we could go back in time and like fix this bug and so. 85%. Of the miners said basically okay here's what we'll do we'll just kind of change, the rules and make up this special one-time rule to basically bail out this Dow contract, and reverse, the effects of of this unfortunate, bug and. So 85%. Of the etherion miners decided, to go ahead with this weird change and execute it the other 15% said hey wait a second you know the rules are the rules like, you know it sucks that there was this bug but like you, know people aren't going to trust this is it feel we're gonna make up the rules as we go along so we're. Gonna keep going under. The original set of rules and that, branch. Of the, blockchain became, aetherium classic, more. Recently there. Was a dispute, in the Bitcoin space where, there's one set of people who wanted, to basically. Do, this thing called segregated. Witness which was probably a good, idea objectively. Although, there, were some issues and how they did it there. Was another set of people who said you know what we really want is more transactions, per second so we need to make the block size bigger also, they were probably motivated by the fact that Segway defeated. Some mining, zatia no some people were done using so well, you had was big. Coin on one hand and then this kind of fork, that shared a same prefix, in the history as Bitcoin called Bitcoin cash and you, know if you think that's kind of a dumb idea and, you don't like Bitcoin, cash or maybe you don't like Bitcoin you, you know if, you had a Bitcoin before and now you have one Bitcoin plus one Bitcoin cash so you, know you could turn around and sell your Bitcoin cash for, $600. Say today and you know who are you to complain you just got a, free $600. Right it's kind of like if you had a company and the company spun, off a subsidiary, even, you got stock, in the parent company and the subsidiary you could sell either one of the two but. The. Problems what would this mean for.

Token. Issuers right suppose, that your bank and you issue dollars. On to the etherium network in say like June of 2016. Well. Now you potentially, face twice as many Redemption. Requests, right because you've, got the same number of dollars on the etherium and the etherium classic, blockchain, right and this is clearly. A very bad right you don't want to face a lot liabilities, for twice as many digital dollars as you've issued, so. The, moral of the story here, is that mining, is actually, pretty scary for, digital. Asset issuers, right, I mean first of all mining is anonymous, right all it means is that somebody with sufficient, resources has, you know executed. The the computation, to extend, or fork. The history and. You, know so, far we've been kind of lucky in with a high profile. Forks, have been kind of announced. In advance and each has been assigned a separate name like aetherium and etherion classic, but, you could imagine you. Know a branch where it's just like -, a fork, where it's like - different you know competing. Pools of miners who are kind of duking it out and saying hey everybody join our mining pool because then we'll give you more. Rewards, and if this goes on for a while and they're, both playing under the same rules and the mining is anonymous you can't even name the two different Fork so how are you gonna say like who's. Allowed to redeem your tokens that you've issued and, who isn't another. Problem is that the mining rewards themselves, might, actually be provide, insufficient, incentive. For. Securing. Your transaction so even, on the biggest block chains like big. Coin and if there the mining rewards today are under ten million dollars a day which. Is dwarfed, by you know the number of you, know the amount of sort of dollars letters like trillions, of dollars moving, between banks, on a daily basis right. And. It's. Kind of worse is that now there's like Bitcoin futures you can trade so if you're a miner and you're about to do something really weird you can actually heads, yourself, against the damage you're going to do to Bitcoin by selling, a bunch of Bitcoin, futures, right and and then you can kind of recall kinds of having you. Know because there might be non-financial, kind of extrinsic, incentives. To do this right let's say you're a forward-looking company, and you say hey I'm gonna issue my stock on Bitcoin by.

Using You. Know colored coins to represent, my shares and now my stock can be traded on a blockchain and, then you do some high profile deal with Taiwan and next thing you know like weird, things are happening to your stock sales they're getting reversed and, whatever and. Well you know nobody's come out and threatened, you but you know that there are a lot of miners in China and like you know this is just would be a very uncomfortable situation to be in okay. So, the. Morla story here is we have to protect. Asset. Issuers from Forks in the blockchain and so, the obvious idea here is why don't you require, whoever, is issuing an asset to endorse all the transactions, in that asset right after all you know the, issuer is a counterparty. To these digital tokens so they should you know be allowed to know you, know who's transferring, the money and make sure that it's not that the the coins aren't getting duplicated, so, you could kind of call this the the PayPal, model right you've got this centrally. Managed ledge or like PayPal keeping track of who has all these tokens, and obviously, PayPal doesn't face the threat, of double, claims on. Redemption because because. Everything, happens through them but. If we went to a world with kind of a thousand, PayPal estrella you know you have a PayPal for your transit, rides of PayPal for your cellphone minutes of PayPal you. Know for. Each of these things the, problem is that you, then can't trade across these different PayPal's, right so this rules out even basic, forex trading and I. Would argue that most, of the kind of the most compelling, applications, of watching involve, introducing, new token types and being able to transact have, atomic transactions, that involve multiple different token, types so. The idea, that we had with. Stellar which is not, profit I'm involved, with is what. If we have many, issuers, issuing, tokens, but all on one ledger however, each. Issuer. Is going, to define tokens, in such a way as to prevent, double, claims, and so what we're gonna do is we're going to have the issuers, each issuer is going to designate. A validator, Authority who. Is kind. Of authoritative, for one portion of the ledger namely the holdings and that issuers. Tokens. Right, and then all the different validators, are going to cooperate to maintain the single, global ledger but, if history did four there'd, be no ambiguity as, to you know which version of a ledger was authoritative, for, for.

Which Token type because you've kind of declared that in advance and these validators they're known parties, are not anonymous at all they're things like banks or you, know big. Companies like IBM for, example so. The. Idea here is that well we, already trust the token issuers to. Remain, solvent and to be willing to redeem tokens because that's what gives the tokens value so, why don't we also trust. The token issuers, to make the transactions, irreversible. And. In. Order to do this we need to make well. So kind of the idea here would be that, imagine, that you, know you only can agree that a transaction happens, when all the sort of counterparties, you care about do so if you're interested, in cashing out dollars. At bank one and rupees at bank four then, you'll, say like hey I'm, only gonna agree to a transaction, when you know my bank in San Francisco, and this other Bank here in Mumbai India have both agreed that this has happened but, these banks, deal, with other banks right and so they're not going to agree that a transaction has happened until, the. Banks that they depend on agree, that's happen who also will depend on other banks and so on until, you kind of take the transitive, closure of these, dependency. Relations, and eventually, the whole world has agreed that this transaction has happened and so at this point, once everybody's, agreed it becomes very hard to roll this back and even if if, you remember in the example I had Bank two we didn't know who it was but it was offering us a good rate getting from dollars to euros and so it banked to somehow, Desai's the transaction, didn't happen but the whole rest of the world does well, who cares you know because in, the end of the day you don't care about. Cashing anything, in it bank - and so bank - could just be in its own weird little fork of the world or if, it wants to exist and continue to exist in the banking system it will have to agree that that this has happened, so. So. In order to make. This happen we need one assumption, and this is something that I call the internet, hypothesis. Right, so the, Internet is this globally. Connected, network. But what's interesting is that there's no central authority that's, dictating, the structure, of the internet right instead. Basically the Internet is the reason out of these pairwise relationships. Between networks, that entrant. Appearing, and transit. Agreements, right, and so, of course this, decentralized. And peering structure. Could have resulted in multiple different Internet's, but it didn't right it resulted, in this one network that we call the Internet and, the reason is that sort of transitively. Everybody, wants to talk to everyone right I may not know who you are but you know I want, to talk to say, Google and you want to talk to Google or I want to talk to somebody who wants to talk to Google and so on if you take sort of that the transitive, convergence. Of everybody, people. Want to talk to you'll. Get kind of a lot, of overlap so the, hypothesis, here is that counterparty. Relationships. In. In. These tokens are actually. You, know have the same kind of a transitive, convergence, right so you have banks dealing, with correspondent, banks dealing with clearing houses and essentially these clearing houses are gonna be like the tier 1 ISPs, of payments, so. Using. This idea we, can define a. New. Kind of consensus. Protocol. That I call federated. Byzantine agreement and, the. Idea is based on Byzantine, agreement which is a known technique for achieving consensus. Amongst, a closed group of nodes but. The problem with classic. Byzantine agreement is that a basis security on this notion, of of. Majorities. Right are super majorities, right so. So. It's vulnerable that this attack called the civil attack where you say hey any like, 2/3 plus 1 of nodes constitute of quorum and so a bad guy comes in and creates you know a hundred fake nodes that, are all controls and so it overwhelms, the number of good nodes so, the idea is we're gonna defeat these civil attacks, by. Choosing, quorum. Composition, in a decentralized, way and, this will be much less symmetric but it'll depend on the actual trust that people place, in the entities, in the system so, this works each node V is gonna pick one or more sets of nodes that, we.

Call Quorum slices, and V. Basically picks, as a quorum slice any set of nodes that it considers important enough to kind of speak for the network as a whole right, so the choice is gonna be based on real-world identities, but in particularly, if you care about, redeeming. Tokens, issued. By by particular nodes you probably want to put those nodes, in, all of your quorum slices so. Given. This idea we can define a federated business in agreement system, as a set of nodes V and this quorum function Q where Q of, little V is the, set of places chosen by node V and, now we can define a quorum, to be a set, of nodes. U. That, is a that, contains at least one quorum, slice of each of its members, so. Here's kind of a simple example I. Have. Four nodes each one is a single quorum slice and I'll visualize, the quorum slices by drawing an arrow from a node to the other members, of its quorum slice right, you can see that V. One has a quorum slice if, you wanted B to be three the other nodes have quorum slice to be 2 B 3 B 4 so if, we consider V 2 V 3 for this is trivially, a quorum, because. It says it contains it is every, one of its members quorum. Slices, what, about V 1 V 2 V 3 that's, a quorum slice it's not a quorum because we want to say I'll agree to anything that V 2 and V 3 do but V 2 and V 3 say, we'll only agree to something if V 4 does so the, smallest quorum, including, V 1 is actually the set of all nodes in this example, so. Here's a little more, realistic example have. A kind of tiered quorum, slice, structure. Reminiscent, of the internet where maybe there's a top tier of quorum of, validators. That depend, on three out of four each other and then maybe a middle tier that depend on two out of four the top tier maybe there's a leafed here but, like the internet there's gonna be no central. Authority appointing. The tier 1 validators. Instead it'll, be left to market choices and maybe a market decides hey you know the top 4 retail banks you know these are these, are what should constitute, the the, top tier validators, but. You don't need complete, consensus, on this so v7, and v8 might, be paranoid and they might say well we, realize we have to get with the big banks but we, don't trust them we also want to depend, some nonprofits. Whose. Incentives. Are differently aligned so they'll say well wait for two out of four big banks to sign off on our transactions, but also one out of these three nonprofits, and then on profits, depend on two. Out of three of each other. Okay. So let's say that this paranoia is well-founded, and Citibank. Walks up to v7. Pays v7, a billion dollars and says hey b7 I just gave you a billion dollars we've got this blockchain, magic so you know it's irreversible, give me a, billion. Dollars worth of goods I'm gonna walk away with them and you should feel secure that you got your payment all right and so b7 says okay I need to out of these four big banks got that I need one of these nonprofits. Got, that this nonprofit needs, them of a non-profit got that these, guys need three out of four got that good everything, is good. Now. Turns out the. Paranoia, is correct, and these big banks are evil so they collude to kind of reverse the effects of this transaction and then. They, walk up to VA and say hey v-eight here's a billion dollars that you know we shouldn't have because we gave it to v8 but it sure looks like we still have it so why don't you give us a billion dollars but the goods will quickly run away with that right. And v8 says well I need two out of four big banks check I also, need one of these non profits well, stellar and AFF aren't going to sign off on this right because they know.

That The, money, now belongs to b7 but maybe ACLU, was kind of lagging behind so, v8, talks to the ACLU but the ACLU depends, on two out of these three nonprofits so you see how you say well sorry I'm not gonna believe this in this unless one of these other nonprofits, signs off and that's. Not gonna happen because the other nonprofits, know this isn't legitimate so those nodes will basically. Protect. The, eight against, this double, spend attack. Okay. So. Basically. I designed. This consensus. Protocol based on this idea and. It. Has some nice properties, like. Basically. Guarantees, safety when, you have quorum, intersection, after removing, all the nodes that deviate. From the protocol and that's, a necessary property, for safety in this kind of model so what I've shown is is also sufficient meaning, that you, know basically SCP, kind of provides optimal, safety so you might regret your choice of quorum slices but you won't regret choosing SCP. Over some other. Consensus. Protocol, it, also guarantees that a well-worn, won't get stuck the, core idea and the protocol, is this, idea of federated, voting right nodes exchange these vote messages but each vote, specifies. The, the senders or the voters quorum slices and so as you collect votes you can kind of dynamically. Discover, whether, or not a set of nodes constitutes. A quorum, so the way this works is there's kind of two phases to the protocol and the first phase you have nodes nominating. Values. Until at least one value has. Unless, and until they've agreed on nomination. Or at least one value so here maybe let's say they've everybody's, they've agreed that tx3, is nominated, and then they kind of continue, to propagate values. Until, they converge, and. Ultimately they will converge. On some set of nominated, values which they can. Combine. In some deterministic, way, and. You can actually show that it's.

They're Guaranteed, that all nodes will eventually converge on the same set of nominated, values now there's, a catch here because of this impossibility. Result, in distributed. Systems for consensus, that, they, will never know even. Though you're guaranteed to converge you never know that you have converged. So you take your best guess that the system is converging and you move on to the second phase called. Balloting, which, is similar, to Byzantine paxos if he if you know Paxos but. It uses federated, voting right so basically you prepare about it and you commit a ballot and if, everybody's, converged in the first round this would be fast and and and, easy, and if. Not well. It'll be a little bit slower but it'll still be guaranteed to be safe and it won't get stuck so as long as the network behaves eventually, you'll you'll confirm some value, okay. So. So. This algorithm. Is, SCP. Is in production use by, this blockchain, called stellar it's like the eighth largest, blockchain. Today, and. We've. Got actually, we. Have a last. Night when I was preparing these slides we had 106, validators. Participating, in consensus, this, morning I happen to check again on the way and it's actually up to 108, so I guess the the system is is growing and they're achieving, consensus, every five seconds, and if there's no it's not expensive to participate, you just need to compute, a few digital signatures. Every five seconds, so, we can you, know have it's it's much cheaper to participate, in the system it's. An open network in anyone can join but of course merely, joining, doesn't mean that you're gonna end up in other people's Quorum slices, right that happens when people know, based, on your reputation that, you know they should they should depend on you or that they want to depend on you so, we've seen all kinds of people participate. Like there's big companies like IBM the, telephone, companies. You. Know money, transmittal, organizations. Universities. There's, a bunch of different types, of validators, in there and our. Primary use case today is for international, payments to make this much cheaper and faster but we've seen all. Kinds of other uses kind of emerged so for example it's being used by coffee futures, by. This company, called Beck's 360, in-app, currencies, geological. Data cryptocurrency. Baskets. You, know basically you name it if you want to issue, a token and you want their instantly, lead to be a secondary market for that token dollars, a good platform for that so.

Compared. To other, approaches. You, know you could try to use Byzantine. Agreement over a closed server set and say well these are the big banks these are the people who should participate. If. That actually happens what you probably end up having happen. Is that a bunch of kind of third parties would come and be like auditing, the performance, of these big, banks, to keep them honest and so, basically you kind of get a poor-man's FBI anyway, so you might as well kind of do it right and get optimal, safety from the thing and. Of course you might also be tempted to use to, proof of work but, again then your consensus. Is integrally, tied up, with coin, distribution, and these incentives, and if you know you're not interested in generating new coins but you want to just issue tokens, back to our real world value that's, not necessarily, the best thing in fact the incentives, might prove. Insufficient. Or ill-suited for. The assets that you were showing all. Right thanks. We. Have time for questions. Actually. I'm really curious in the so you have 100, yeah. Yeah. I think what people choose is a much smaller, subset of those I think of those 108, there's, probably a most 30, that people actually depend, on. But. Like. I said it's all over the way so IBM has like you know five. Of them or something and all around the world. Stellar obviously, has. Like three of them because we're the people, putting this out but, yeah then there's like a telco, there's. I. Mean. You can't you can go to. What. Does its stellar have. It linked in the slides of some there's, like various websites that, that, that, lists, these I was, like - Linda does one that's, it that's a telco there's, like tempo. Is like issues these euro back tokens, there. Are money transmittal, organization. There's. Yeah. I'm, not sure all. Kinds of people basically. Of. The. Effect of. Yeah. I mean I think this, is a this, is a big problem with with, the, proof-of-work stuff it's not there's, not it's. Not an issue in, stellar because you, know as an, issue or you you're protected, I mean you're you're the one issuing the tokens so you know basically, you could. So. So, yeah so if you're concerned about bribes then you definitely would want to use. Something like stellar and run, a validator, yourself, such, that you could you, could guarantee that you know no funny transactions, go through that you don't approve, and nothing gets rolled back. Hi. You. Said well not eight notes right so those, notes getting, any. Notes. Are getting any benefits like token, or anything by joining it no, it's more like why do you run a mail server instead of telling all of your employees to use Gmail or something because you know it's not that expensive and you want some control you. Know it's it's convenient to like have control over it so it's, that mining, Bitcoin, is hugely, expensive, right running, a stellar validator yeah you need like a computer, and you know you, know few. Gigs of memory or whatever but it's not. It's. Not particularly onerous right you do it for the control.

Mainly. Brewpub work as, an old than, anything, else you, know there is no proof of work you were digitally. Signing a message saying like yes I agree that this is the next batch of transactions. So, it's, it's very cheap to run a validator, and. What. You get is the ability to protect yourself, against double spans because. You. Tell people you're dealing with hey the, transaction, hasn't gone through until my validator, has signed off on it and my validator won't sign off until all the people I consider important. Have signed off on it. There. Is you, do not you, do not make money as a validator, there are there's a small transaction. Fee for just anti-spam, reasons but that goes into like an inflation, pool we do not reward validators. Any more than we don't reward, mail servers, right like you run a mail server because it's convenient for you to have email and because it's not that expensive you don't run it because you get mining. Rewards or anything so that's, that's our model and but it's proving. To work, out right because a lot of people they want a copy of the ledger state anyway so they might as well run a validator or they're issuing a token and they want to protect themselves against double spend attacks example. I build. The data, distributor, application, on top of seller so. Let's. My algorithm say is that I distribute, 30%. Of the data, across, the validator or not eight nodes they. Are storing my data but they are not gaining anything so you have any restrictions, on stellar like you can yeah so there's there's, a native, currency which is sort of counterparty, free and there's. A minimum, balance in, an account in that currency and that minimum balance is proportional, to how much ledger state you are taking, up, unlike. A UT exobase blockchain, like Bitcoin. We, can truncate history, you don't have to keep the whole history so, you can actually reduce, the amount of state and get back to your minute your minimum, balance, but. But basically like it boils down to yes there's, anti-spam, protections. To make it expensive, to consume a huge amount of state in the ledger. You.

2018-06-18 00:10